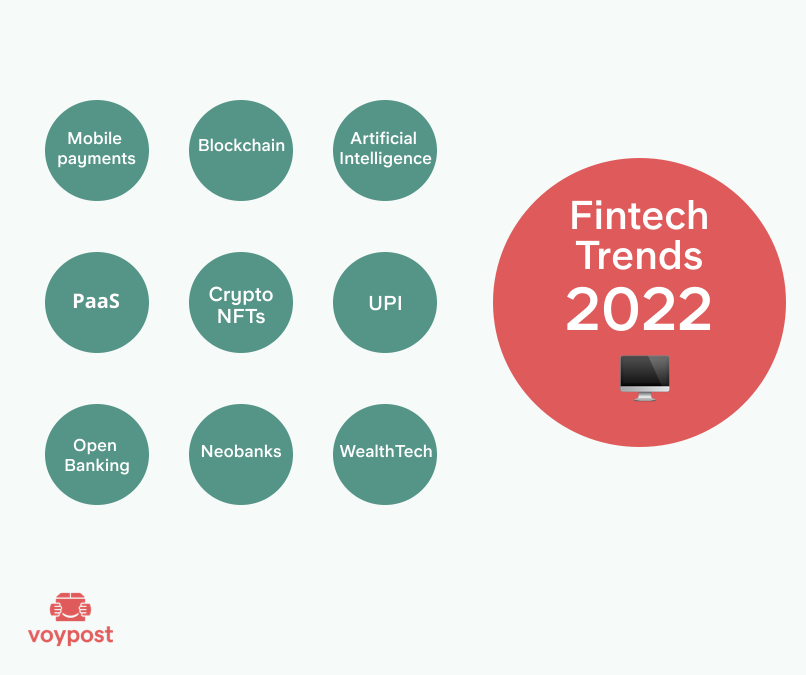

Key Fintech Trends to keep an eye on in 2022

What are the recent trends in financial innovations? Here you can find the TOP latest fintech trends for this year and various ideas on how to use them in your product.

March 01, 2022

7 min read

Global free market economy facilitates the emergence of powerful brands and cutting-edge financial technologies. Even a tiny advantage may turn the tables for a given brand in the long run.

Which technologies provide the much needed advantage to strive in the global market in 2022?

Which finance trends cannot be overlooked so that FinTech startups don’t end up in a failure?

Mobile payments

They say that to make a genuinely useful and successful product, one needs to combine two or more smoking-hot or highly demanded trends. Take Uber, for instance. Uber merely followed the formula “taxi+mobile app” at the right moment.

The speed-to-market means everything, so when a particular trend takes the market by storm, it is best to find a niche application for it as soon as possible.

The mobile pay technology, in particular, first appeared in 1997 providing users an ability to pay via SMS. Contemporary mobile payment apps remove the need for cash, greatly simplify day-to-day transactions (such as traffic fines), and facilitate global trade in general – especially in case of intellectual property.

Users can set up regular payments (as in case of Boost Mobile payments) or pay with their phone in supermarkets and traffic with NFC mobile payments.

Blockchain and Smart Contracts

Money is increasingly becoming digital. Will it become all digital and what consequences will it incur? The most concerning issues in this regard are security and privacy: both are brilliantly resolved by blockchain.

Blockchain is basically a decentralized ledger. It is not governed by a central authority. Instead, all the users with a copy of the ledger participate in the governance and verify the validity of network transactions. The work of this kind (i.e., transaction validation) is usually rewarded with digital currency. Everything else is ruled out by code: emission rates, reward size and frequency, the next user who is allowed to write a new block into the chain, extra security measures, et cetera.

A cut above the original chains (such as Bitcoin and its forks) is a chain that enables its users to launch their own currencies with unique behaviors (Ethereum or Solana, for example). The ways user-created assets behave are described in smart contracts, which is why there’s no surprise a smart contract developer profession is gaining popularity.

The top 10 smart contract platforms, just for the sake of example, are Ethereum, Solana, Polkadot, Tron, Cardano, Avalanche, Cosmos, Elrond, Tezos, and Near Protocol.

Cryptocurrencies and NFTs

The concepts of blockchain and cryptocurrency go hand in hand. Blockchain is the underlying technology that ensures a secure and fast circulation of cryptocurrencies.

Decentralization allows blockchain network users to perform peer-to-peer (P2P) transactions. As opposed to banks that collect the transaction fees in a centralized manner, blockchain ensures a more or less even distribution of transaction fees between all the users. Therefore, the ultimate P2P meaning is expanding the financial freedom of the users.

Blockchain developers have already implemented all common financial services on blockchain, like peer-to-peer lending services or money exchanges.

The biggest FinTech companies are exploring cryptocurrencies one way or another: integration of crypto payments helps them retain customers.

Evidently, blockchains are becoming more versatile, and one of their recent much-praised developments is the non-fungible token (NFT) standard. These assets potentially can describe any physical object resulting in its “tokenization”. For example, if you buy a pair of Nike sneakers, you get a pair of the virtual ones as well, which you can wear in blockchain-based online games.

Artificial Intelligence

Artificial Intelligence (AI) itself is a fairly old technology, however it has gained a couple of interesting applications recently.

Smart customer support chatbots are harder to tell apart from humans day by day. They effectively resolve the vast majority of user queries, leaving the option to contact a living support agent for unique cases.

Being able to process vast loads of statistical data, AI builds highly precise prediction models and learns on the go. This capability is useful both on the scale of large businesses and individuals. Who would object to having an AI advisor in their pocket to give expert diet suggestions every now and then?

Payment as a Service (PaaS)

The Payment-as-a-Service term stands for the set of cloud services that manage different payment systems for a given corporal user. It is probably going to be confused with the Platform-as-a-Service term from now on since they both have the same PaaS acronym.

PaaS cloud software helps global companies deal with the following challenges:

Currency conversion;

Legal compliance across all payment system providers;

Compatibility with legacy banking systems;

Integration with third-party services (both FinTech and non-FinTech);

Data collection, analytics, and reporting out of the box.

Startups and SMBs that use PaaS don’t have to develop their own payment systems while large entities save time on building their own scalable, highly technological solutions.

Unified Payment Interface (UPI)

UPI is one of the banking technology trends that helps its users to effortlessly carry over the wealth between various bank accounts.

The UPI meaning is “unified payment interface”, and it comes in the form of a mobile application. It has been tested in India for about five years now and proven its convenience to users: it removes the need to singlehandedly manage multiple bank accounts and works faster than decentralized solutions.

The users don’t have to enter their sensitive data every time they perform a transaction: it is conveniently aggregated in the UPI app account along with the transaction history and other useful details.

The best UPI apps are well-known: Google Pay, Amazon Pay, Paytm, PhonePe, and BHIM.

The speed and scalability provided by UPI apps sparked a debate about possible blockchain-powered hybrid solutions.

Open Banking

The open banking model stands out on this list of digital banking trends because it is rather a government-imposed regulation than a breakthrough technology. After the European Union issued its Revised Payment Service Directive (PSD2) all the banks under the EU jurisdiction are forced to become more transparent.

What is open banking from a user’s standpoint? It provides more control over one’s personal data, a broader choice of financial services, and immediate visibility of indecent players.

As for the FinTech developers who push aspiring startups onward, the open banking API’s provide extensive access to user data, enabling them to better tailor their service to the needs of their target audience.

Neobanks

What is a neobank? A banking institution that prioritizes digital services or goes digital-only is referred to as a neobank. That basically covers the neobank definition.

It is without a doubt one of the positive trends in online banking not only because it cuts the maintenance costs for the bank owners but because the customers benefit from increased service quality and decreased fees. The executives of a given bank invest in efficient digital solutions instead of physical offices, paperwork, and personnel.

A given neobank might have a developed network of ATMs for the customers who prefer to work with cash.

WealthTech

The WealthTech umbrella term stands for any wealth management technology provided either as a B2B or B2C service.

Fintech wealth management has made a lot of notable advancements in the recent decades; the software and hardware that were previously available only to the industry insiders have now become available to the broader public.

Open-source software and the general movement towards the extension of personal freedoms have made a significant contribution to the development of advanced tools, openly available for regular users.

All automated financial advisors belong to WealthTech. Online marketplaces and exchanges, too, are examples of WealthTech applications. One could also use them to look up the best FinTech stock or compare the service conditions of digital banks online, manage a personal investment portfolio, and do plenty of other finance-related routines.

The unhindered exchange of wealth and value directly improves the overall welfare of the world. The faster these digital banking trends gain wider adoption, the better. If you can contribute to their development merely by using them – do so.

You could also contribute via running FinTech app development services or investing into them, FinTech acquisition, or financial services marketing. Anytime you need these services yourself – just ask the pros.